Auto Insurance in Our Future: Emerging Trends and Technologies

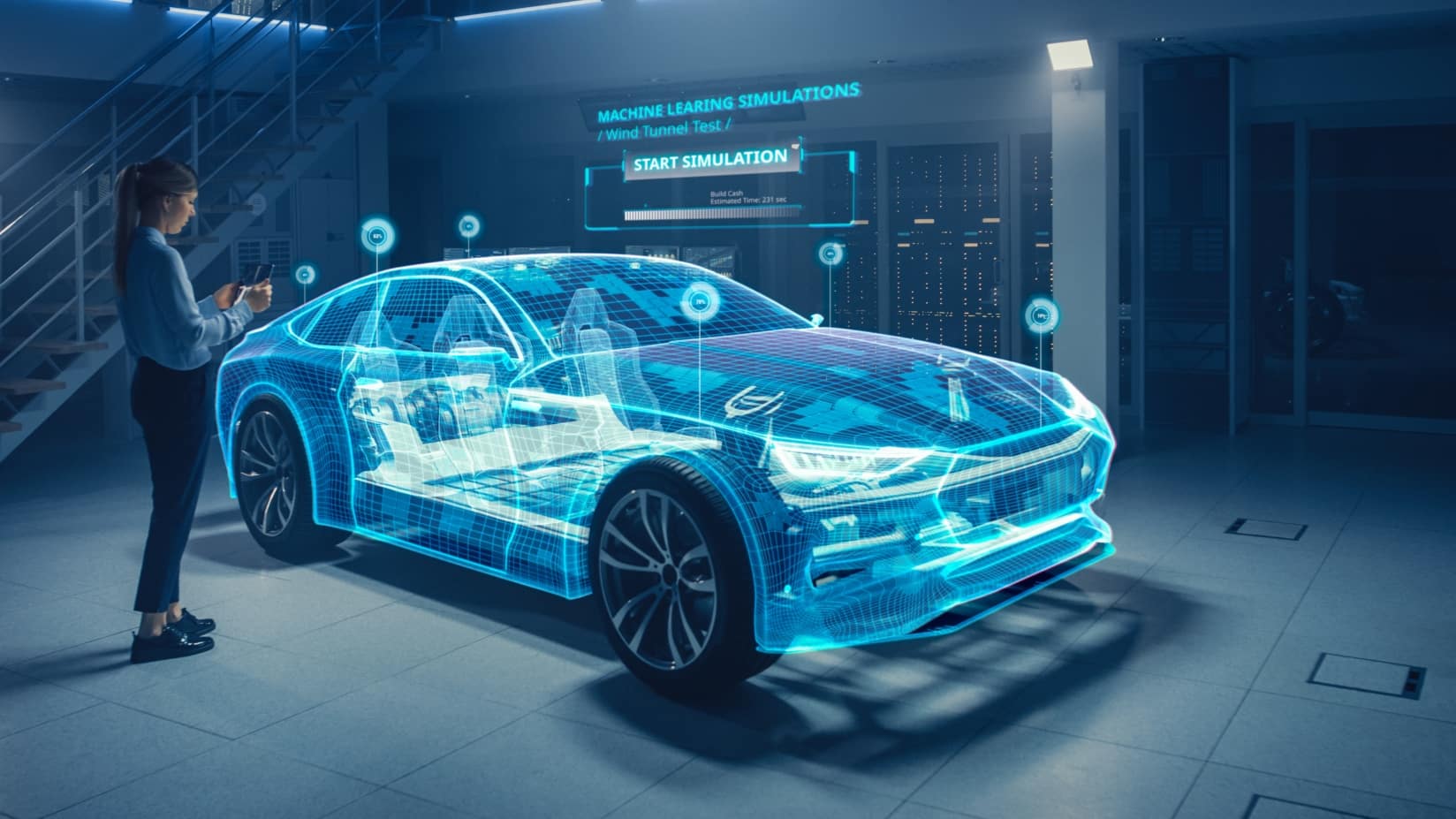

Auto Insurance in Our Future: Emerging Trends and Technologies, The collision protection industry is going through an extraordinary shift driven by quick progressions in innovation, changing shopper assumptions, and developing vehicle plans. As we plan ahead, auto insurance will turn out to be more customized, information driven, and custom-made to address the issues of a world with electric vehicles, independent technology, and connected cars. In this article, we’ll investigate the key patterns that are probably going to shape collision protection before very long and what these progressions will mean for drivers, guarantors, and society in general.

1. Independent Vehicles and Changing Risk Models

The Ascent of Independent Driving

The broad reception of self-driving vehicles will in a general sense change the idea of collision protection. With independent vehicles taking control from drivers, risk in mishaps is supposed to move. Customarily, obligation has zeroed in on the driver, yet later on, it might move toward makers or programming suppliers liable for the innovation that drives the vehicle. Auto Insurance in Our Future: Emerging Trends and Technologies.

New Risk and Item Obligation Policies

As independent vehicles become more normal, guarantors might zero in on product risk policies for vehicle producers, programming organizations, and sensor suppliers, as opposed to individual driver obligation. For example, a breakdown in the vehicle’s working framework or a product mistake could make the producer at risk in case of a mishap. Subsequently, automakers might begin packaging insurance inclusion with vehicles, offering customers complete assurance while diminishing the requirement for customary driver-based contracts. Auto Insurance in Our Future: Emerging Trends and Technologies.

2. Telematics and Utilization Based Protection (UBI)

How Telematics is Changing Insurance

Telematics innovation permits guarantors to screen driving ways of behaving through gadgets introduced in vehicles or through versatile applications. These gadgets gather information on speed, slowing down, speed increase, mileage, and time of day voyaged, giving a more definite perspective on a driver’s propensities.

Advantages of Use Based Protection (UBI)

UBI approaches, which compute charges in light of real driving way of behaving, are acquiring fame. Pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) models permit drivers to be charged in light of their driving propensities, compensating safe driving with lower expenses. For drivers, this implies more pleasant evaluating in view of certifiable way of behaving as opposed to general measurements. Telematics-based UBI will probably turn into the standard, offering drivers motivators for safe propensities and giving guarantors a more exact method for evaluating risk.

3. Electric Vehicles and Specific Coverage

The Developing Prevalence of EVs

As electric vehicles (EVs) become standard, back up plans are adjusting their inclusion to meet the one of a kind necessities of EV proprietors. EVs accompany unmistakable dangers, for example, battery issues, explicit fix expenses, and exceptional substitution prerequisites.

EV-Explicit Protection Policies

Future accident protection will probably incorporate specialized inclusion for EVs to address these distinctions. Inclusion could incorporate insurance for battery substitution, emergency aides for charging issues, and limits for drivers utilizing green innovation. As the EV market extends, guarantors should consider how to give thorough yet practical strategies custom-made to these vehicles.

4. Man-made consciousness for Quicker Claims Processing

Artificial intelligence Driven Cases Handling

The utilization of artificial knowledge (AI) in accident protection is supposed to smooth out and computerize numerous parts of the cases cycle. Computer based intelligence can break down pictures of vehicle harm, evaluate fix expenses, and even interaction claims in no time, altogether decreasing hang tight times and further developing proficiency for clients.

Improved Misrepresentation Identification and Prevention

Artificial intelligence additionally improves misrepresentation identification abilities, examining examples and irregularities in cases to distinguish possible extortion. This can assist with bringing down costs for safety net providers and lessen expenses for policyholders by guaranteeing that assets are designated to real cases. Quicker, more precise cases handling will prompt a more certain client experience, with faster goals and less entanglements.

5. Associated and Savvy Vehicles: New Information and Network protection Concerns

Associated Vehicles and Information Collection

Current vehicles are progressively connected to the internet and furnished with sensors that gather huge measures of information. This network empowers insurance suppliers to survey continuous information on a vehicle’s condition, area, and use, assisting them with offering more precise statements and customized contracts.

Tending to Online protection Risks

With availability comes the gamble of digital assaults. As associated and independent vehicles become more predominant, they might be helpless against hacking and information breaks. Future accident coverage strategies might incorporate cybersecurity coverage to shield drivers from potential digital dangers, taking care of the expenses of information recuperation, digital harm, and even obligation if there should be an occurrence of vindictive impedance with a vehicle’s working framework.

6. Shared (P2P) Protection Models

Local area Based Protection Solutions

Shared (P2P) insurance models, where gatherings of policyholders pool their payments, are turning into a well known option in contrast to customary protection. In these models, expenses are utilized to cover every part’s cases, and on the off chance that there are no cases, the unused assets can be gotten back to individuals or turned over.

Lower Expenses and Transparency

P2P protection makes a local area situated approach that empowers cautious driving and offers possibly lower costs. For example, individuals who keep up with clean driving records or drive securely could profit from lower charges. This model is great for more youthful drivers or those keen on additional straightforward and cooperative protection choices.

7. Natural and Social Obligation in Auto Insurance

Green Limits and Eco-Accommodating Policies

As ecological mindfulness increments, auto safety net providers are beginning to offer green discounts for low-outflow or eco-friendly vehicles. Drivers of electric and half and half vehicles might get lower expenses, and a few guarantors might try and reward diminished driving with unique impetuses for carpooling, utilizing public transportation, or taking on eco-accommodating driving propensities.

Carbon Offset Programs

Some auto guarantors are presenting carbon offset programs as a component of their strategies, permitting drivers to balance the outflows created by their vehicle. Future collision protection will probably offer more reasonable choices that mirror the upsides of eco-cognizant drivers, giving both monetary and natural advantages.

8. Moment, On-Request Protection Coverage

Adaptability Through On-Request Insurance

For drivers who use vehicles just once in a while or for explicit purposes, on-request insurance offers an adaptable arrangement. With on-request arrangements, inclusion can be enacted just while required, permitting drivers to pay for protection just during explicit outings or time spans. This is great for the individuals who lease vehicles or use ridesharing administrations discontinuously.

Miniature Insurance Contracts for Impermanent Coverage

Miniature protection is one more pattern where drivers can buy protection for transient requirements. This could be utilized for rental vehicles, little excursions, or explicit occasions. On-request and miniature protection choices give a savvy option in contrast to drivers who don’t demand full-time inclusion, giving them more command over their protection costs.

9. Blockchain and Straightforwardness in Information Management

Secure, Straightforward Information Through Blockchain

Blockchain innovation offers a straightforward and secure technique for putting away information, which could be a distinct advantage for collision protection. By recording driver and cases information on a changeless blockchain, safety net providers can diminish misrepresentation and increment entrust with policyholders.

Savvy Agreements for Robotized Claims

Blockchain-based shrewd agreements can robotize claims handling, executing installments naturally when certain circumstances are met. This considers quicker, more productive cases dealing with, eliminating delegates and making a clear cycle for the two guarantors and drivers.

10. InsurTech and the Computerized First Experience

Inventive Protection Innovation Companies

InsurTech organizations are upsetting the protection business by offering computerized first, client driven encounters. These organizations frequently utilize versatile applications and stages to smooth out statements, strategy the executives, and cases, making the protection cycle quicker and more available.

Upgraded Client care with artificial intelligence and Chatbots

InsurTech suppliers are likewise utilizing computer based intelligence fueled chatbots and menial helpers to improve client assistance, directing policyholders through the protection cycle with customized help. As additional conventional safety net providers embrace these computerized instruments, drivers can expect a consistent, proficient experience beginning to end, with additional self-administration choices and simple to-get to data.

The eventual fate of accident coverage is dynamic and energizing, set apart by personalization, flexibility, and technology-driven solutions. As independent vehicles, associated vehicles, and eco-accommodating practices become norm, collision protection will adjust to meet the changing necessities of drivers in a cutting edge world.

We Love Cricket