The Future of Car Insurance Quotes: Personalized, Real-Time, and Data-Driven

Introduction

The Future of Car Insurance Quotes: Personalized, Real-Time, and Data-Driven ,As the vehicle protection industry advances close by innovation, car protection quotes are turning out to be progressively customized, information driven, and proficient. With the ascent of telematics, man-made reasoning, and advanced stages, acquiring precise and fair vehicle protection statements will turn out to be quicker and more customized to every driver’s way of behaving and needs. Here, we investigate the fate of vehicle protection quotes and the imaginative patterns that will reshape how purchasers connect with protection suppliers.

1. Telematics-Based Statements: Customizing Expenses Through Driving Data

How Telematics Functions in Vehicle Insurance

Telematics innovation utilizes gadgets, as cell phone applications or in-vehicle equipment, to screen driving propensities. These gadgets track measurements like speed, slowing down, speed increase, mileage, and even time spent driving. Telematics empowers protection suppliers to accumulate certifiable information on every driver, making an individualized gamble profile. For safe drivers, this can result in essentially lower charges and more exact statements. The Future of Car Insurance Quotes: Personalized, Real-Time, and Data-Driven.

Utilization Based Protection (UBI)

Utilization Based Protection (UBI) models are an arising pattern that influences telematics information. UBI permits insurance suppliers to offer pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD) contracts. With these models, drivers are cited and charged in light of their genuine traveling conduct and mileage, making insurance payments more pleasant and more intelligent of individual gamble.

2. Artificial intelligence Driven Moment Quotes

Man-made brainpower for Quicker, Precise Quotes

Man-made brainpower (artificial intelligence) has changed the manner in which vehicle protection suppliers produce statements. High level calculations examine a lot of information, like a driver’s set of experiences, area, and vehicle type, to offer instant quotes that are more exact and customized. Man-made intelligence instruments can rapidly evaluate risk, saving time for the two guarantors and drivers. The Future of Car Insurance Quotes: Personalized, Real-Time, and Data-Driven.

Prescient Examination for Citing and Renewal

Prescient investigation likewise empowers safety net providers to expect client needs and deal proactive statements. For instance, simulated intelligence can break down information to decide whether a driver’s strategy needs changes in light of improving on driving propensities. At the point when recharging opportunity arrives, insurance agency can offer refreshed statements that mirror a driver’s flow risk profile, guaranteeing decency and flexibility.

3. Constant, On-Request Statements for the Sharing Economy

On-Request Protection Options

With the ascent of the gig economy and administrations like ridesharing, there’s a rising interest for on-request vehicle protection quotes. Drivers who use vehicles irregularly or just for explicit purposes can get statements in view of brief or periodic use. This approach gives drivers more prominent adaptability to actuate inclusion just while required, setting aside cash and diminishing waste in expenses.

Miniature Protection Policies

Miniature protection is one more pattern pointed toward giving statements to present moment or insignificant inclusion. This could apply to drivers who utilize rental vehicles, or intermittent drivers who need momentary protection. On-request, miniature protection statements can be given in a split second through applications, permitting drivers to enact and pay for protection just during explicit excursions.

4. Blockchain and Straightforward Quotes

Blockchain for Information Security and Transparency

Blockchain innovation offers a decentralized and secure method for overseeing driver information, making it ideal for vehicle protection. By safely putting away driver information on a blockchain, protection suppliers can improve data transparency and make citing processes more effective. Blockchain likewise makes an unmistakable, carefully designed record of a driver’s set of experiences, helping insurance agency precisely evaluate hazard and proposition fair statements.

Savvy Agreements for Smoothed out Citing and Claims

Shrewd agreements are self-executing arrangements put away on a blockchain. In vehicle protection, they can be utilized to computerize the citing system in view of pre-set conditions. For example, a shrewd agreement could give a moment quote in the event that a driver meets explicit standards, for example, having a perfect driving record. This smoothes out the citing system and makes it simpler for drivers to get solid, exact statements.

5. AI for Persistent Valuing Adjustments

Dynamic Valuing In light of Machine Learning

AI (ML) calculations can persistently dissect information to change vehicle protection quotes progressively. With admittance to data like driving examples, mishap history, and territorial gamble factors, ML empowers safety net providers to powerfully refine and change statements. This approach results in adaptive evaluating models that develop close by drivers’ way of behaving, presenting to-date and fair estimating.

Tweaked Limits and Incentives

AI likewise assists safety net providers with distinguishing designs that could qualify drivers for personalized discounts. For example, ML calculations can identify safe driving ways of behaving or reliability designs and consequently apply important limits. These limits can be reflected in a driver’s statements, guaranteeing more cutthroat and customized evaluating.

6. Eco-Accommodating Statements and Green Discounts

Motivators for Low-Discharge Vehicles

With additional customers picking electric or cross breed vehicles, protection suppliers are progressively offering green discounts as a feature of the citing system. Safety net providers perceive that drivers of low-discharge vehicles by and large represent a lower ecological gamble and might be more secure drivers. This eco-accommodating center permits drivers to get discounted quotes for earth cognizant vehicle decisions.

Carbon Offset Protection Programs

As a feature of green protection drives, a few organizations might offer statements that incorporate discretionary carbon offset programs. This permits drivers to adjust their vehicle’s fossil fuel byproducts as a component of their strategy. By consolidating natural variables, future vehicle protection statements will probably mirror a pledge to manageability and prize drivers who pick eco-accommodating vehicles.

7. Versatile and Computerized Citing Platforms

Consistent Citing Through Versatile Apps

Versatile applications and computerized stages permit drivers to get statements and oversee arrangements immediately. With a couple of taps, clients can include their data, look at costs, and get statements customized to their particular necessities. Some applications even use optical character acknowledgment (OCR) innovation to check driver’s permit data, making the interaction significantly quicker.

Self-Administration and Virtual Assistance

Computerized first organizations are coordinating virtual colleagues and chatbots to offer help and guide clients through the citing system. These computer based intelligence driven devices give replies to questions and improve on the most common way of acquiring statements, permitting clients to explore arrangements and modify their inclusion progressively.

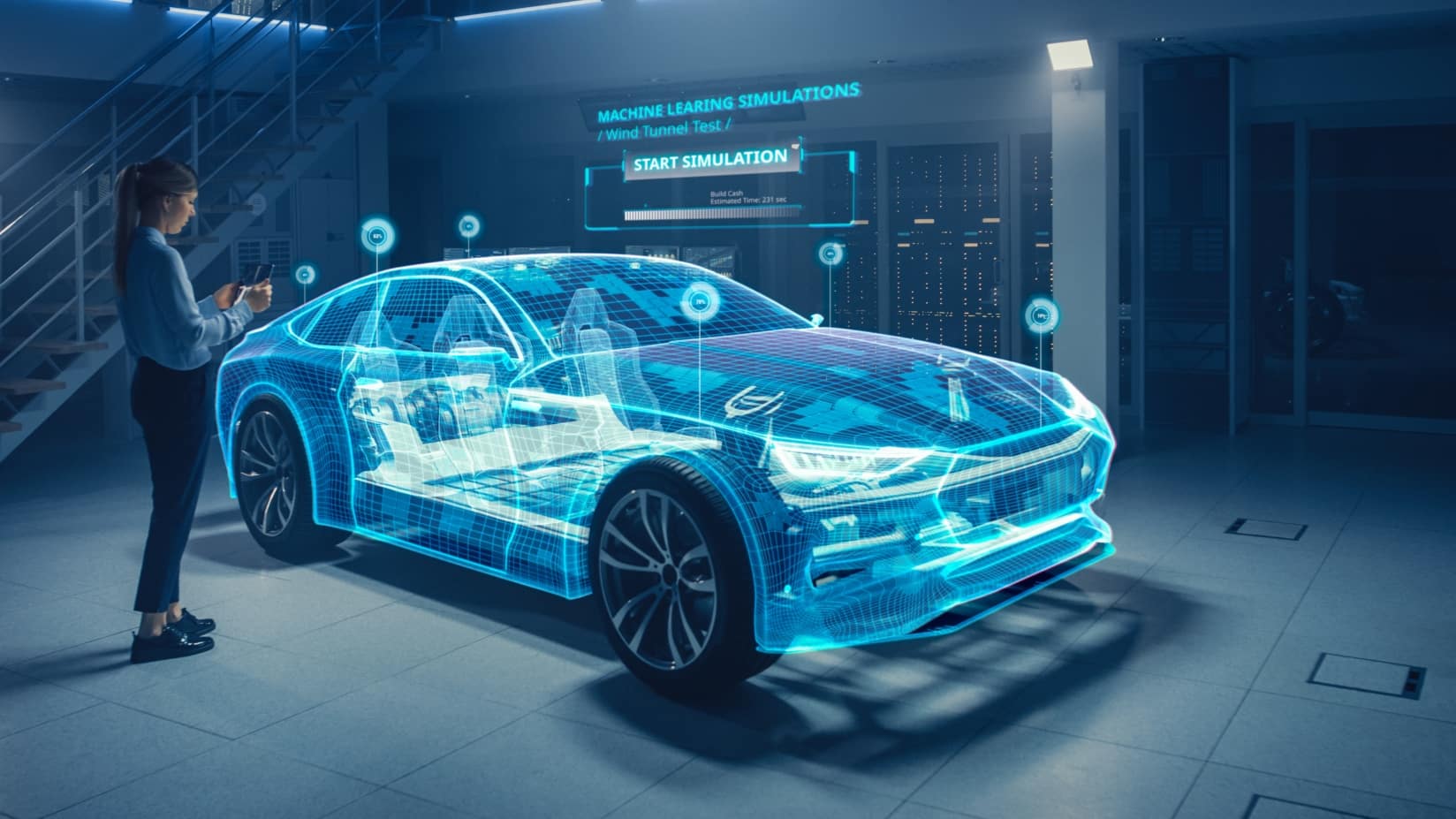

8. Increased Reality and Virtual Quotes

Increased Reality for Continuous Harm Assessment

Later on, expanded reality (AR) may assume a part in creating exact statements after a mishap. Drivers could utilize AR to filter their vehicle with a cell phone, and the innovation would evaluate noticeable harm and give a statement in view of fix gauges. This will smooth out the citing system and deal quicker, more helpful evaluations in the event of mishaps.

Virtual Meetings for Customized Advice

Virtual meetings utilizing video calls or AR could permit protection specialists to give customized exhortation and help, assisting clients with picking the best inclusion choices. By offering direction through virtual channels, back up plans can assist clients with figuring out their statements exhaustively and tailor approaches to their necessities.

The eventual fate of vehicle protection quotes is pushing toward precision, personalization, and accessibility. By utilizing cutting edge innovations like computer based intelligence, telematics, blockchain, and even AR, protection suppliers can convey statements that reflect genuine driving ways of behaving, individual requirements, and supportable decisions. As these advancements keep on developing, drivers can anticipate quicker, more exact, and more pleasant vehicle protection quotes in the years to come.

We Love Cricket