The Future of Car Insurance: Trends, Innovations, and What to Expect

The Future of Car Insurance: Trends, Innovations, and What to Expect, As innovation propels and the scene of automobile ownership shifts, vehicle protection is ready for massive changes before long. In a world pushing toward autonomous vehicles, electric vehicles, and associated technology, the protection business is adjusting to cover new dangers and deal improved securities. In this article, we’ll investigate the critical patterns and developments molding the eventual fate of vehicle protection, too as what drivers can expect as they explore this advancing scene.

1. Independent Vehicles and the Change in Liability

The Ascent of Independent Cars

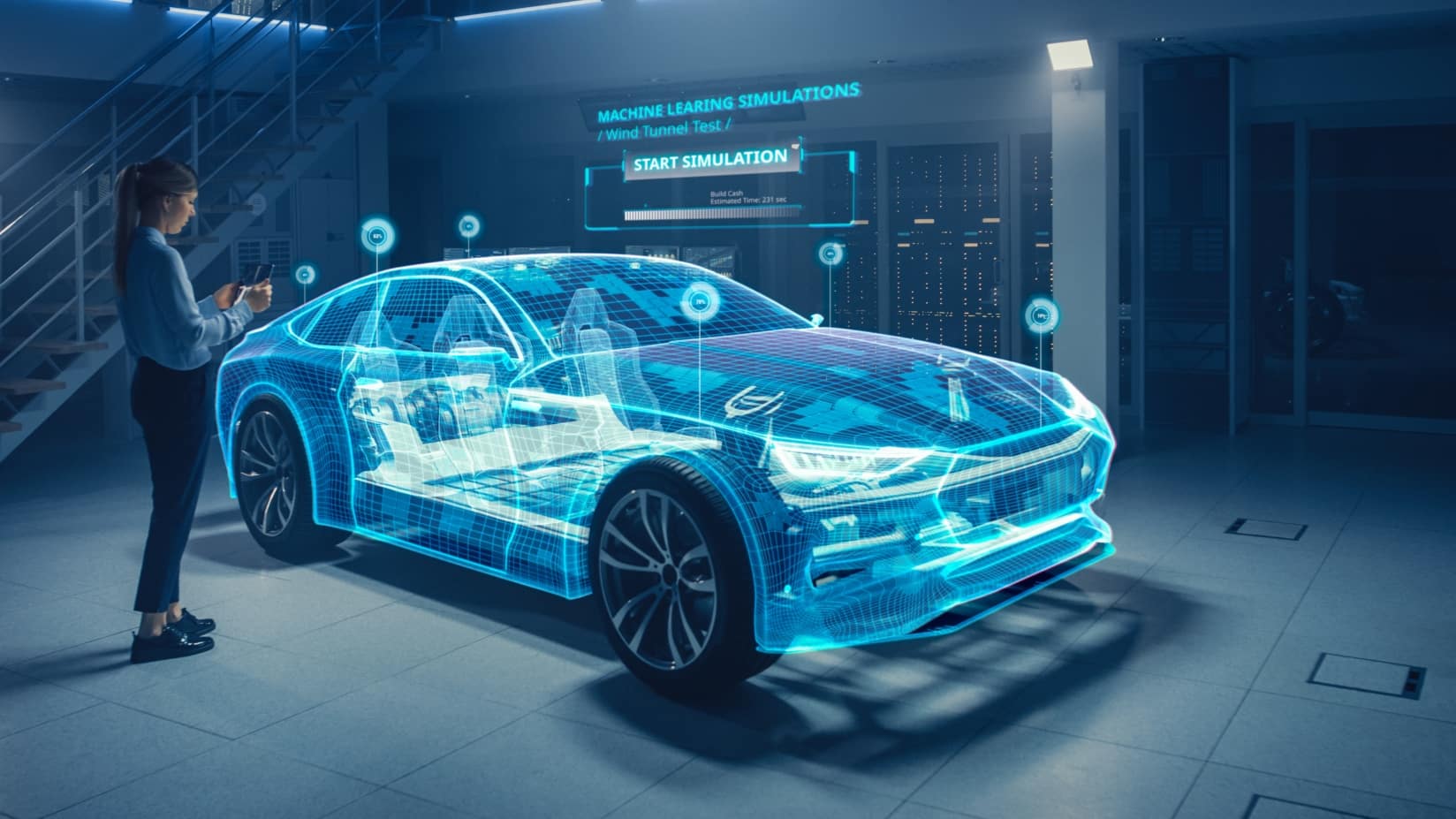

The presentation of independent, or self-driving, vehicles has made a significant change in how protection suppliers view responsibility and hazard. In completely independent vehicles, the driver plays a latent job, bringing up issues about who ought to be dependable in the event of a mishap. Would it be a good idea for it to be the vehicle proprietor, the vehicle maker, or even the product engineer? The Future of Car Insurance: Trends, Innovations, and What to Expect.

Changing Responsibility Models

In a future with far and wide reception of independent vehicles, safety net providers might zero in more on product liability strategies for vehicle producers and programming organizations as opposed to individual driver arrangements. A few automakers, similar to Tesla, have proactively indicated packaging their own insurance contracts with vehicles, a methodology that could turn into the standard. The Future of Car Insurance: Trends, Innovations, and What to Expect.

2. Utilization Based Protection and Telematics

Pay-As-You-Drive Protection Models

Quite possibly of the main pattern in vehicle insurance is the shift toward usage-based protection (UBI), where not entirely settled by genuine driving way of behaving rather than a level month to month rate. This model is progressively well known, particularly as more protection suppliers use telematics – gadgets that screen driving propensities.

How Telematics Works

Telematics innovation, frequently coordinated through a versatile application or a module gadget, tracks factors like speed, slowing down, mileage, and, surprisingly, the hour of day you drive. Safe drivers can profit from lower expenses, making an impetus to take on more secure propensities.

As we push ahead, telematics is probably going to turn into a standard component in vehicle insurance contracts, offering customized expenses in light of genuine information as opposed to general presumptions.

3. Electric Vehicles and New Inclusion Options

The Electric Vehicle Surge

As electric vehicles (EVs) fill in prevalence, protection suppliers are adjusting to cover the one of a kind parts of EV possession. These vehicles have various dangers and advantages, from battery-related issues to interesting fix costs and charging foundation.

Particular Inclusion for EVs

Future vehicle insurance contracts might offer specialized coverage for electric vehicles, including assurance against issues like battery debasement, emergency aides explicitly for EVs, and inclusion for home charging stations. As EV possession grows, vehicle protection will keep on advancing to meet these particular requirements.

4. Reconciliation of Man-made consciousness in Cases Processing

Computer based intelligence Driven Claims

Man-made consciousness is now being utilized to smooth out the claims process, and its job in vehicle protection will just grow. Simulated intelligence can evaluate harm through photographs, gauge fix expenses, and even cycle claims independently now and again, diminishing the requirement for human intercession.

Quicker, More Precise Cases Processing

Artificial intelligence can likewise assist with forestalling false cases by dissecting designs in information that might show extortion, which can assist with decreasing expenses for the two guarantors and policyholders. This makes claims handling speedier and more effective, upgrading the client experience and lessening delays.

5. Network safety in Associated and Independent Vehicles

Safeguarding Against Digital Risks

As vehicles become more associated, they’re likewise more defenseless against network protection dangers. Connected cars have progressed highlights like distant programming refreshes, GPS following, and infotainment frameworks, yet this availability can open them to hacking and information robbery.

Network Protection Policies

To address these dangers, insurance agency are starting to offer cybersecurity coverage for associated vehicles. This sort of arrangement would shield drivers from information breaks, hacking, and other digital dangers, which is particularly pertinent as additional vehicles become piece of the Web of Things (IoT).

6. Distributed Protection Models

The Sharing Economy and Insurance

As ridesharing and vehicle sharing administrations become more famous, peer-to-peer (P2P) insurance models are getting some forward movement. P2P insurance permits people to pool their payments and backing each other in case of a mishap or guarantee, frequently with lower expenses and more adaptable terms.

A People group Based Way to deal with Insurance

In a P2P model, policyholders might get unused expenses as cashback on the off chance that no cases are made, encouraging a feeling of local area and boosting cautious driving. This approach could turn out to be more common, especially among more youthful drivers intrigued by cheaper and more cooperative protection choices.

7. Ecological and Moral Variables in Vehicle Insurance

Eco-Accommodating Arrangements and Discounts

As natural mindfulness develops, so does the interest for eco-accommodating protection policies. Guarantors are beginning to compensate drivers who pick eco-friendly or low-emanation vehicles with lower expenses. A few suppliers might much offer “green” strategies that give a piece of charges to natural drives or boost carpooling and decreased driving.

The Ascent of Supportable Protection Options

Hope to see more insurance agency making sustainable protection options that line up with eco-cognizant qualities. Drivers could profit from limits or exceptional compensations for driving eco-accommodating vehicles or taking on manageable driving practices.

8. On-Request and Adaptable Protection Options

Moment, On-Request Coverage

As the sharing economy develops, many individuals at this point not own vehicles altogether yet at the same time need incidental protection. The future will probably bring more on-request insurance choices, where drivers can enact inclusion just when required, for example, for a brief excursion or a transitory rental.

Month to month or Pay-Per-Use Insurance

Because of buyer interest for adaptability, protection suppliers are probably going to extend pay-per-use choices that permit drivers to pick inclusion levels in view of ongoing necessities. This model is great for intermittent drivers, giving a financially savvy answer for the individuals who don’t drive everyday.

9. Blockchain Innovation and Transparency

Further developed Information Security and Transparency

Blockchain innovation offers a solid and straightforward method for overseeing information, which could assist with changing how vehicle protection claims are handled and put away. Blockchain can give a permanent record of exchanges and guarantee chronicles, diminishing extortion and expanding trust among back up plans and policyholders.

Smoothed out Cases Through Savvy Contracts

Savvy contracts on blockchain stages could robotize claims handling, dispensing with middle people and accelerating the interaction. Blockchain likewise advances information protection, permitting clients to impart just vital data to guarantors.

10. The Shift Towards InsurTech Companies

Ascent of Computerized First Protection Companies

InsurTech organizations, which use innovation to further develop effectiveness and client experience, are upsetting the vehicle protection market. These organizations frequently give quicker, more easy to understand choices, from moment statements to speedy cases handling by means of applications.

Improved Client Experience

As customary safety net providers embrace InsurTech arrangements, clients can expect seamless computerized experiences with highlights like artificial intelligence based chatbots, versatile applications for strategy the executives, and quicker online statements. This shift is reshaping vehicle protection by putting clients at the middle, offering natural and adaptable arrangements.

The fate of vehicle protection is being formed by headways in innovation, changes in vehicle possession, and a developing spotlight on supportability and adaptability. As we move into this new time, vehicle protection is set to turn out to be more customized, eco-cognizant, and innovation driven than any time in recent memory.

We Love Cricket