The State of Law Insurance Agencies in 2024: A Comprehensive Overview

The State of Law Insurance Agencies in 2024, the protection business keeps on developing, driven by mechanical headways, administrative changes, and moving business sector requests. One region that has seen critical development and change is the specialty of regulation protection, which envelops many items intended to safeguard law offices, legitimate experts, and clients engaged with lawful debates. Regulation protection organizations, especially those taking care of the novel requirements of the legitimate calling, have adjusted to the advanced scene by offering inventive arrangements, utilizing innovation, and remaining in front of arising chances.

This article will investigate the present status of regulation protection organizations in 2024, analyzing the items and administrations they offer, the difficulties they face, and the patterns forming the business.

Grasping Regulation Protection

Regulation insurance alludes to a class of protection contracts explicitly intended for legitimate experts, including law offices, legal counselors, paralegals, and even clients engaged with lawful issues. A specific type of inclusion tends to the dangers innate in the legitimate calling, like misbehavior, proficient obligation, blunders and oversights, digital dangers, and even business chances related with dealing with a regulation practice.

The two most conspicuous sorts of protection in the lawful field are:

- Legal Negligence Insurance (otherwise called Proficient Risk Protection): This is one of the most fundamental types of inclusion for legal counselors. It safeguards legitimate experts from cases of carelessness, blunders, or oversights in the arrangement of lawful administrations. Given the exceptionally nitty gritty and basic nature of legitimate work, the gamble of committing errors is critical, making this kind of protection irreplaceable for attorneys.

- Law Firm Property and Setback Insurance: notwithstanding proficient obligation inclusion, law offices likewise need security against general business gambles, for example, property harm, robbery, or representative injury. This protection frequently incorporates inclusion for places of business, hardware, and business interference, which are significant for guaranteeing the congruity of activities.

Key Administrations Given by Regulation Protection Offices in 2024

Regulation protection organizations in 2024 proposition a different scope of items to meet the consistently developing requirements of the legitimate business. The absolute most normal administrations include:

1. Cyber Responsibility Insurance

As the legitimate business keeps on embracing computerized instruments and lead a huge part of its work on the web, the gamble of cyberattacks and information breaks has risen emphatically. Digital risk protection is progressively turning into an unquestionable necessity for law offices, everything being equal. This sort of protection helps cover the expenses related with information breaks, for example, warning expenses, legitimate charges, and possible fines. It can likewise give security against digital blackmail, for example, ransomware assaults, which have been on the ascent lately.

Law offices hold delicate client data, including individual, monetary, and clinical information, making them practical objectives for cybercriminals. In light of this developing danger, regulation protection organizations are offering far reaching digital risk inclusion custom fitted explicitly to the requirements of lawful experts.

2. Employment Practices Responsibility Protection (EPLI)

Work related claims, like unfair end, provocation, segregation, or counter, are among the most well-known claims looked by organizations, including law offices. Business Practices Responsibility Protection (EPLI) is intended to safeguard law offices from claims made by representatives, clients, or previous workers. With regards to law offices, where issues connected with working environment direct and morals are central, EPLI is fundamental for relieving the gamble of business related claims.

This protection takes care of legitimate expenses, settlements, and harms emerging from cases of inappropriate working environment rehearses, and numerous regulation protection organizations have extended their EPLI contributions to incorporate more particular inclusion connected with the novel difficulties looked by lawful experts. The State of Law Insurance Agencies in 2024.

3. Lawyer’s Devotion Bond

A legal counselor’s devotion bond shields clients from extortion or contemptibility committed by the attorney or different individuals from the law office. This kind of inclusion is critical for firms that handle client reserves, for example, those engaged with trust account the executives. On the off chance that a legal counselor is found to have stolen or misused client cash, the loyalty bond helps cover the monetary misfortune.

In 2024, as trust and client connections stay fundamental to the legitimate calling, law offices are progressively looking for constancy securities to give an additional layer of safety and exhibit their obligation to moral practices. In 2024, as trust and client connections stay fundamental to the legitimate calling, law offices are progressively looking for constancy securities to give an additional layer of safety and exhibit their obligation to moral practices. .

4. Business Interference Insurance

Numerous law offices are vigorously dependent on their actual office spaces, however in case of a cataclysmic event, fire, or other unexpected conditions, these workplaces might be compelled to close. Business interference protection helps law offices keep up with monetary solidness during periods when they can’t work regularly. It can cover lost income, lease, and even representative pay rates, permitting firms to climate interruptions without confronting serious monetary difficulty.

Arising Patterns in Regulation Protection in 2024

As the legitimate business keeps on modernizing, a few key patterns are forming the law protection scene. These patterns not just reflect changes in the lawful calling itself yet in addition the more extensive social, mechanical, and administrative climate.

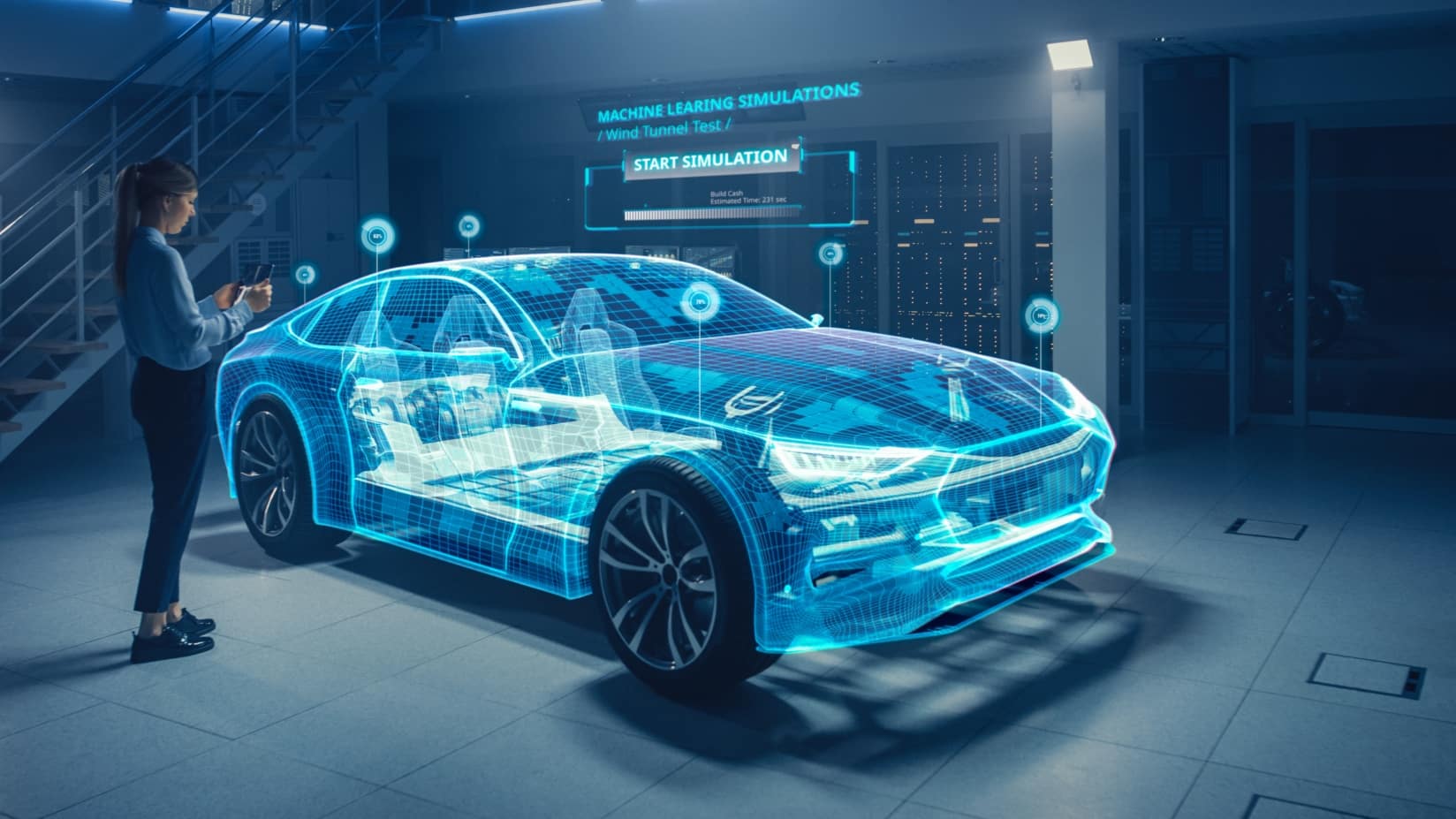

1. Increased Utilization of Innovation and Man-made reasoning (AI)

Quite possibly of the main change in the lawful business as of late is the ascent of innovation and simulated intelligence devices that improve effectiveness, efficiency, and administration conveyance. Regulation protection organizations are embracing innovation to smooth out endorsing processes, further develop claims the board, and furnish clients with more custom fitted protection items.

Specifically, man-made intelligence controlled examination and chance appraisal apparatuses are empowering guarantors to all the more likely foresee the probability of cases, permitting them to offer more precise evaluating and inclusion. Besides, some regulation insurance organizations are embracing innovation to offer self-administration entrances where law offices can deal with their contracts, record cases, and access risk the executives assets.

2. Regulatory Changes and Compliance

As the legitimate calling turns out to be more globalized, regulation protection offices are progressively zeroing in on consistence with a developing administrative scene. New regulations and guidelines, especially in regions like information protection and network safety, are compelling guarantors to adjust their contributions to meet the particular requirements of law offices.

For instance, the Overall Information Security Guideline (GDPR) in the European Association and the California Purchaser Protection Act (CCPA) in the US have focused on information assurance for law offices, and protection items are advancing to address these worries. Law offices that work across borders need insurance contracts that cover homegrown dangers as well as worldwide consistence issues.

3. Evolving Client Expectations

In 2024, clients are turning out to be more knowing with regards to picking legitimate specialist organizations, and they are progressively expecting law offices to show impressive skill, straightforwardness, and moral practices. Law offices that have far reaching protection inclusion, including digital risk, negligence, and worker security protection, are viewed as more dependable and reliable by clients.

Regulation protection organizations are answering by offering adjustable protection bundles that permit firms to choose the inclusion that best meets their particular requirements. These custom-made bundles assist firms with adjusting cost and assurance, while likewise living up to the assumptions of their clients.

Challenges Confronting Regulation Protection Offices

In spite of the open doors and development inside the law protection area, organizations face a few difficulties. A portion of the vital difficulties in 2024 include:

1. Rising Online protection Risks

With the rising dependence on advanced apparatuses and the developing danger of cyberattacks, law offices are confronting critical openness to digital dangers. Protection organizations should remain on the ball in giving network safety inclusion that is both exhaustive and versatile to new kinds of computerized dangers. This requires continuous interest in risk evaluation and the advancement of specific arrangements.

2. Cost Pressures

Insurance installments for legitimate experts have been rising, particularly as the expenses of cases and claims increment. Law offices, especially more modest practices, may find it challenging to adjust the requirement for sufficient inclusion with the increasing expense of charges. Protection organizations should track down ways of offering reasonable arrangements while guaranteeing they can deal with their own gamble openness. The State of Law Insurance Agencies in 2024.

End

In 2024, regulation protection organizations are assuming a basic part in assisting lawful experts with exploring a quickly changing scene of dangers and potential open doors. The interest for particular protection items is expanding as law offices face advancing difficulties connected with network safety, consistence, and business coherence. The State of Law Insurance Agencies in 2024.

By embracing innovation, adjusting to new administrative prerequisites, and offering imaginative protection arrangements, regulation protection organizations are situating themselves as key accomplices to the lawful calling. As the legitimate business keeps on advancing, the job of regulation protection will turn out to be significantly more fundamental to the supportability and progress of law offices all over the planet.

We Love Cricket